Have you ever asked yourself:

In what order should I allocate my income?

What should I plan for when first creating a budget?

How can I ensure I won’t go over budget?

Should I prioritize savings over investments? Which investment accounts should I contribute to first?

Creating financial health is akin to cultivating a thriving garden. It requires patience, strategy, and a clear understanding of the environment. Just as there is no correct way to garden, achieving financial wellness comes through various methodologies, each tailored to individual circumstances and goals.

In this blog post, we’ll compare and contrast some well-known approaches to gaining financial health—from Dave Ramsey’s popular “Baby Steps” to the Money Guy’s Financial Order of OperationsTM. Whether you’re taking your first step towards fiscal responsibility or seeking to add some process and organization to your money allocation, this analysis will analyze the different paths you can take to create a future of financial stability.

Let’s start with one of the most popular financial hierarchies:

Dave Ramsey’s 7 Baby Steps

Dave’s baby steps are designed to teach people how to better manage their money, focus on small wins to build momentum, and empower people to make financial decisions with confidence moving forward. Dave’s steps are designed for people who want to be completely debt-free.

Here are the baby steps:

Baby Step 1: Save $1,000 for Your Starter Emergency Fund

The Philosophy: Avoid digging yourself into a deeper hole when you’re trying to work your way out of one.

The Rebuttal: In these days, $1000 may not be enough of a cushion. Consumers’ average emergency expense is $1400. Also, every person has different unexpected expenses that could arise. Each person needs to think through the list of potential things that could arise, and plan their emergency fund accordingly.

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

The Philosophy: In summary, the debt snowball means to pay off your smallest debts first, regardless of interest rate, until it is fully paid off. You do this over and over until all accounts are paid off. From a psychological perspective, this allows you to have ‘small wins’ that provide momentum to keep going.

The Rebuttal: In contrast to the debt snowball is the debt avalanche which focuses on paying off loans with the highest interest rates. In theory, you will save more money with the avalanche method. However, you must be committed to keep going when it may take longer to pay off a large loan first.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

The Philosophy: Protect yourself against a big surprise, such as the loss of a job or a medical event. Having money in the bank can ensure you are less stressed if a bigger surprise rears its ugly head without adding more debt again.

The Rebuttal: There could be other things that you want to do before a fully funded emergency fund. These things could include collecting your full employer match for a retirement account or using some money to start your own business. As an alternative, you could create a surprise plan; this could include steps you could take in the event of something happening such as selling off assets, filing for unemployment, or taking the opportunity to try something new.

Baby Step 4: Invest 15% of Your Household Income in Retirement

The Philosophy: This is the step where you leave behind the debts and start focusing on the future. Building a retirement fund is important to ensure you are able to live comfortably later in life.

The Rebuttal: The amount they recommend saving might not be the right amount for you to reach your retirement goals. You need to also know your starting point, how many years you have left to retire, and the amount you will need during retirement. There are many videos and calculators out there that can help with that – look out for a future blog post regarding financial calculators!

Baby Step 5: Save for Your Children’s College Fund

The Philosophy: After you have taken care of your own retirement, you can begin saving for your children. There are several types of college funds, but Dave recommends either a 529 or an Education Savings Account, which both grow tax-free!

The Rebuttal: If you don’t have children, this step would not apply to you. If you do, great! Your children could be close to college or 18 years away. Eighteen years is quite a while and the world could change by then. With college costs rapidly increasing and the rise of access to knowledge via the internet, it is entirely possible that your child doesn’t want to go to college. It may be wise to think of alternative ways to gift your child a head start. Some of these ideas may include a Roth IRA in their name, a ‘Uniform Transfer to Minors’ or ‘Uniform Gift to Minors’ (UTMA/UGMA), or even helping them invest in real estate.

Baby Step 6: Pay Off Your Home Early

The Philosophy: Typically housing is the largest expenditure of Americans. Putting extra money towards your mortgage can often save significant amounts over the life of the loan, plus remove the burden of another bill that is due each month in the event of future financial hardship.

The Rebuttal: While paying off your home can give you peace of mind, it may not always add up. More than 60% of homeowners have a mortgage interest rate that is less than 4%. Given that many High Yield Savings Accounts are offering 4.5%+, it would be wiser to place them in this safe investment, or even alternative investments such as the stock market, treasury bonds, or even CDs given your risk tolerance and whether you need access to the cash soon.

Baby Step 7: Build Wealth and Give

The Philosophy: Once you have zero debt, it is easy to live your life on your terms. This allows you to do anything you want with your money, including continuing to invest, be charitable, and leave a legacy to your children.

The Rebuttal: Dave Ramsey is very focused on having zero debt as the ultimate goal. And while this is a great achievement, it may not be for everyone. For instance, many people pursue their passions by utilizing loans (AKA leverage). Many others invest in real estate for an additional income stream. I fully believe in utilizing debt to make more money as long as you have done the due diligence to ensure your success.

Overall, Dave’s 7 baby steps are geared towards those who:

- Have significant debt and/or are irresponsible with their money

- Want to be debt free

- Like following specific systems

- Aren’t interested in alternative or risky investments

The Money Guy: Financial Order of OperationsTM

The Financial Order of OperationsTM is a 9-step process from The Money Guys who have a YouTube show all about personal finance. They give simple and logical money advice, and their financial order of operations can be personalized to your situation. The downside is that it costs $249 to take their course and utilize their tools.

Step 1: Deductibles

The Philosophy: Similar to Dave Ramsey’s baby steps, the first step is to ensure you have enough money in an emergency. Unlike Dave, the amount they recommend to save is more personalized and they offer tools to help you determine the amount you may need in an emergency based on important insurance deductibles.

The Rebuttal: I like that this philosophy is much more personalized than the ‘save $1000’. That being said, some emergencies may arise that aren’t insured (or you find yourself in a situation without insurance), and in this case that amount may not be the correct one for you.

Step 2: Employer Match

The Philosophy: An employer match refers to money your employer will contribute to your retirement account that matches the amount you put in. For example, if your employer has a 3% match, and you make $100K per year, if you contribute 3% ($3000 per year) then your employer will also contribute 3% for a total of 6% contributions. This is money for which you are guaranteed a return for close to zero risk. This is about the best investment you can make!

The Rebuttal: It is general knowledge that taking advantage of an employer match should be a top priority as to not forego guaranteed returns. That being said, if your employer match is high (10-15%) and you are unable to cover later steps in the FOO such as paying off short term debt that is accumulating interest each month, it may be worthwhile to pay that off before you can fully take advantage of your employer match.

Step 3: High Interest Debt

The Philosophy: Debt can be a heavy burden over your head. Unlike Dave Ramsey’s baby steps, the FOO suggests tackling high-interest debt first. This may mean you are paying off a very large loan for quite a while but will save you money in the long run. What counts as high-interest debt? Per the Money Guy website, “Student loans count as high-interest debt if the interest rate is greater than 6% in your 20s, 5% in your 30s, 4% in your 40s, and at any interest rate at 50 and beyond, and auto debt should be paid down using our guidelines (put 20% down, pay off in 3 years or less, and keep the payment below 8% of gross income; luxury vehicles should be paid for in cash or paid off in one year).”

The Rebuttal: If you tackle high interest debt first, but these are your largest loans, it could take a while before it is paid off. Psychologically, it could be tough to keep going without a small win (such as paying off a smaller loan completely). If you are the type of person who likes to check the tasks off your list, paying down the smaller debts first may be for you.

Step 4: Emergency Reserves

The Philosophy: The Money Guy recommends at least 3-6 months’ worth of living expenses saved in addition to the deductibles from Step 1. This is to ensure you can cover long-term losses such as a layoff, medical or auto emergency, or your furnace going out (but hopefully not all at once).

The Rebuttal: Similar to Dave Ramsey’s baby step #3, there could be other things that you want to do before a fully funded emergency fund. These things could include using money to start your own business or saving money for a down payment on a home. Though riskier, some may be willing to accept this risk. As an alternative, you could create a surprise plan; this could include steps you could take in the event of something happening such as selling off assets, filing for unemployment, moving in with family members, or renting out a room in your home.

Step 5: Roth and HSA Contributions

The Philosophy: When thinking of retirement accounts, it is best to first max out a Roth Individual Retirement Account (IRA) or Health Savings Account because these after-tax contributions grow tax-free. The assumption here is that when you withdraw at age 59.5, it is completely tax-free. This is great because you may be unsure what your tax rate will be at this age.

The Rebuttal: Every situation is unique, and it may make more sense to max out your Traditional IRA before your Roth. One reason might be that you make too much money to contribute to a Roth since there are income thresholds that you must be under in order to contribute. Another reason may be that you believe your tax rate will be lower in the future than it is now. It is important for you to evaluate which order makes the most sense for you.

Step 6: Max-Out Retirement Options

The Philosophy: Maxing out your retirement accounts will ensure you have enough money once you stop working. This can be a significant relief for most and relieves your children from having to bear any of your financial burden.

The Rebuttal: While retirement accounts have many tax advantages, the one downside is that they are not accessible without penalty or fee until you are 59.5. If you have a plan to retire before that age, then this step may not be the right one for you. Additionally, there may be other short-term things you want to save for such as college funds for your children or a dream vacation.

Step 7: Hyper-Accumulation

The Philosophy: With the growing uncertainties behind social security funding, you wan to ensure you have your own assets for financial health. This means saving 20-25% of your gross income.

The Rebuttal: Everyone has different financial goals. Saving 20-25% of your income may help you achieve those goals or may not. It is highly dependent upon your income. Only you can decide if this is the right amount for you!

Step 8: Pre-Paid Future Expenses

The Philosophy: Retirement is the number one priority, followed by everything else, such as saving for a child’s college fund or that new boat you always wanted. The philosophy is similar to an emergency situation on an airplane – put on your own oxygen mask before you can help your child. Ensure your own financial well-being is in order before funding other things.

The Rebuttal: If you’ve made it this far in the FOO process, you’ve probably set yourself up for success. While it might make financial sense to do all these in order, you may feel more comfortable putting your children first before complete financial freedom. I think as long as you are on the right track, allocating a small amount towards a college fund earlier in the process is completely acceptable. In fact, the earlier you do it the better as it gives the account more time to grow.

Step 9: Low-interest Debt Repayment

The Philosophy: If you have low-interest debt, paying it off is the last step as it can be better deployed in other places.

The Rebuttal: The interest rate and market environment can be tricky to time. While you may make more money by investing versus paying off low-interest debt, sometimes that may not be guaranteed. Additionally, relieving yourself from the burden of all debt and being able to say “I’m debt free” can offer a peace of mind that is priceless.

The Financial Order of Operations, in my opinion, allows for more flexibility than Dave Ramsey’s baby steps. The Money Guy offers a course on their FOO that provides a detailed guide and personalized process to help you achieve your goals for $249.

The FOO is best for individuals who are:

- Already smart with their money and not in huge amounts of debt, especially consumer debt such as credit cards

- Want a process that has some flexibility and personalization built-in

- Willing to spend money to get on the right track ($249)

And finally…

The Prime Directive

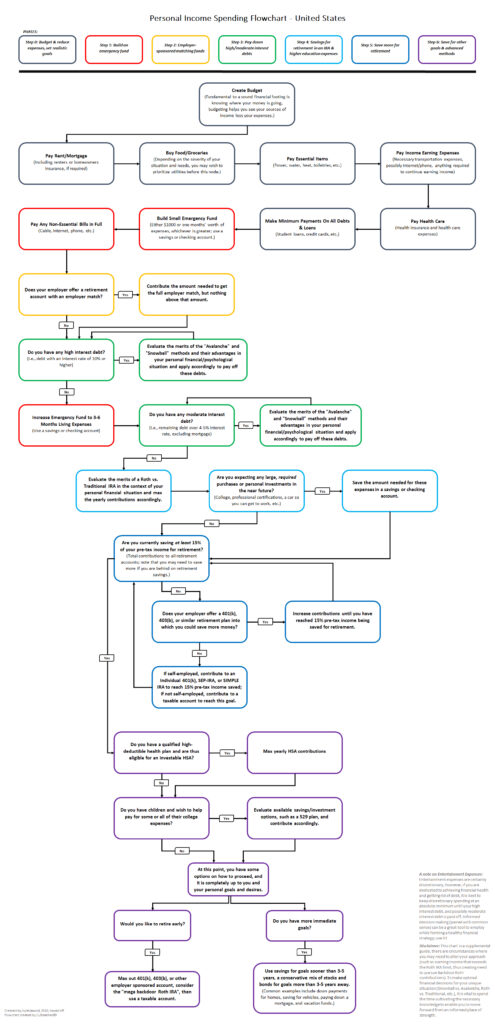

The final process flowchart in this analysis is the “Prime Directive” which can be found on the Personal Finance Reddit wiki. This is the highly accepted order of money allocation within this community of 18 million members. They also offer advice on specific topics on their Wiki.

The Prime Directive is a process flowchart whereby that is personalized depending on the situation and can offer multiple directions.

What I like about it: It starts with budgeting and reducing expenses, which is the first step to free up money to allocate. I think this as a first step is the most necessary and sets the user up for success.

The Philosophy: Establishing a flow chart allows for a directive that has multiple options for the users based on their unique situation. For example, contributing to an HSA is one of the steps IF you have a high deductible health plan. If not, then you would say ‘No’ and be redirected to the next step.

The Rebuttal: Like the other processes above, it puts certain investments and allocations ahead of others (i.e. college fund is one of the latest steps), and doesn’t account for other mini-savings goals such as family vacations. Additionally, there are other alternative investments that an individual may want to consider such as real estate.

At the end of the day, the steps you take need to be right for you. Between your risk tolerance level to what keeps you up at night, tackling your debt and learning how to save and invest is deeply personal. There are many paths to financial freedom. My recommendation is to run scenarios based on the above recommendations to figure out which one is right for you.

Always remember – Earn, Save, Invest, Repeat!

Have questions? Shoot me a DM on Instagram or email me at moneymatters@smallstepswealth-com

Other Financial Process Resources:

https://www.edrawmax.com/article/personal-finance-flowchart.html